The B2B payments landscape is undergoing significant transformation driven by fintech innovations aimed at solving longstanding inefficiencies. Traditional B2B payment methods such as ACH, wire transfers, and SWIFT transactions are often cumbersome, slow, and costly, particularly when crossing borders. Fintech solutions are stepping in to address these pain points, delivering enhanced transparency, speed, and interoperability for businesses.

How Fintech Addresses B2B Payment Challenges:

1. Speed and Efficiency:

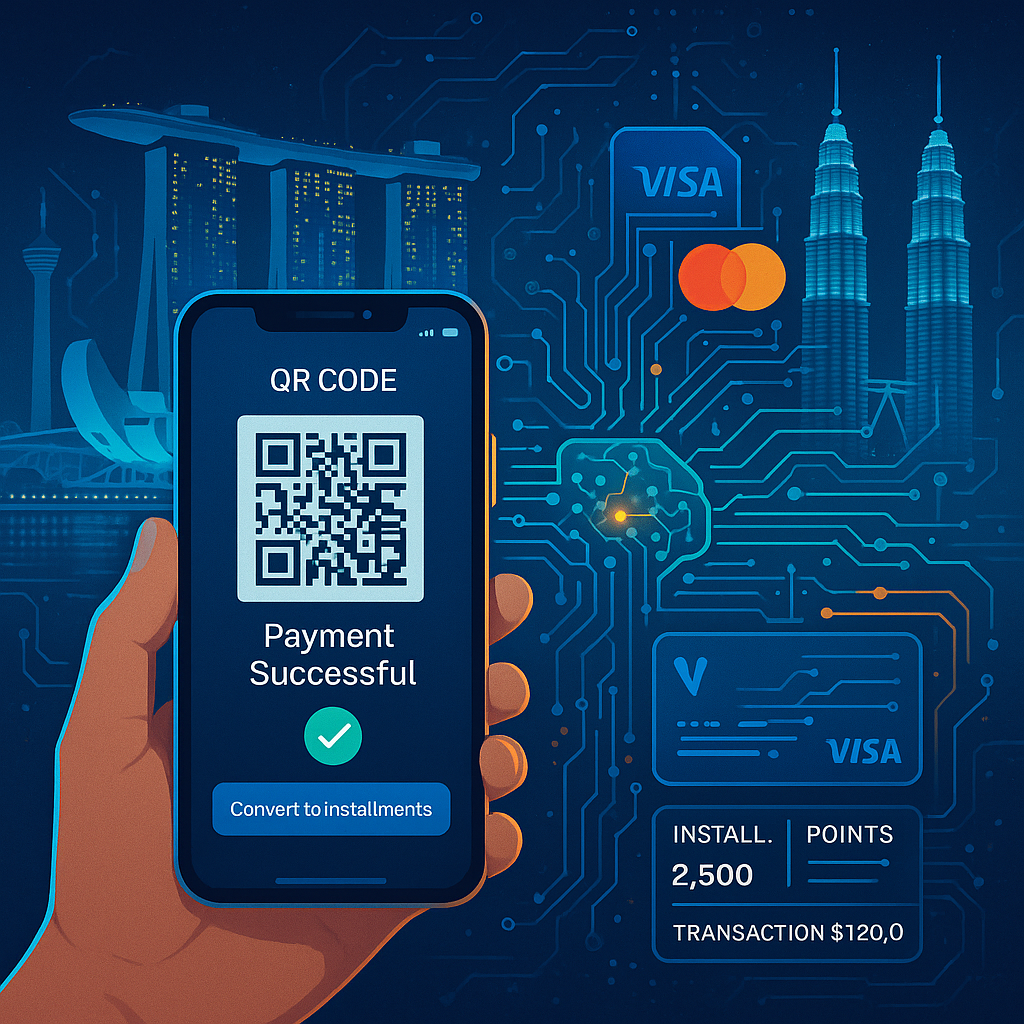

Fintech platforms optimize transaction processes through automation, API-driven integrations, and real-time payment rails. This significantly reduces delays associated with traditional methods like ACH or SWIFT. Companies benefit from improved cash flow management and faster reconciliation cycles.

2. Cost Reduction:

Cross-border transactions traditionally involve high fees and unfavorable exchange rates. Fintech companies leverage innovative models, including peer-to-peer matching and blockchain-enabled settlements, to minimize fees, reduce forex spreads, and lower the overall cost burden on businesses.

3. Enhanced Transparency:

Fintech solutions offer detailed tracking and reporting capabilities, enabling businesses to monitor payment status, FX rates, and compliance requirements seamlessly. Real-time dashboards and analytics provide visibility, enabling informed financial decisions and efficient treasury management.

Stablecoins: A Transformational Intermediary

Stablecoins—digital assets pegged to stable fiat currencies—are emerging as a powerful fintech innovation for streamlining B2B transactions, particularly in cross-border contexts. Here’s how the process typically works:

- The payer initiates payment in their local fiat currency.

- The fintech platform converts this fiat currency into a stablecoin.

- The stablecoin is transferred via blockchain networks rapidly and securely.

- Upon receipt, the stablecoin is automatically converted back into the recipient’s fiat currency.

This mechanism preserves fiat convenience at both ends of the transaction while harnessing blockchain’s benefits—speed, transparency, lower cost, and enhanced security.

Advantages of Using Stablecoins for B2B Payments:

- Reduced Settlement Time: Transactions settle in minutes or seconds compared to days for traditional cross-border transfers.

- Lower Transaction Fees: Stablecoins significantly cut intermediary fees and reduce FX volatility.

- Increased Liquidity and Accessibility: Businesses gain instant access to liquidity, enhancing working capital efficiency.

- Improved Traceability and Compliance: Blockchain-based stablecoin transactions provide transparent, immutable audit trails, simplifying compliance and regulatory reporting.

Real-World Applications and Future Potential:

Industries like manufacturing, logistics, e-commerce, and travel have already begun integrating fintech and stablecoin solutions to facilitate supplier payments, invoice settlements, and global payroll. Companies benefit through streamlined workflows, lower operational costs, and improved financial control.

Looking ahead, the adoption of stablecoins and fintech platforms will likely accelerate as businesses seek agility and competitive advantage in a globalized economy. Regulators and financial institutions are becoming increasingly supportive, recognizing stablecoins’ potential to modernize financial infrastructure while retaining robust governance and compliance frameworks.

In conclusion, fintech’s integration of stablecoins offers a compelling solution for transforming B2B payments, promising to redefine both local and international transaction standards.