SMEs power 40%+ of Southeast Asia’s GDP—yet they’re still stuck between two worlds:

✅ The opportunity: Digital payments are exploding (e-commerce, ads, logistics, B2B flows).

❌ The roadblock: Rising fraud, fragmented tools, and a lack of scalable credit.

For banks, this isn’t just a gap—it’s a $100B+ opportunity waiting to be unlocked.

But here’s the catch: SMEs don’t need another “feature-rich” card. They need smart, secure financial tools built for their real-world problems.

🔐 Digital Growth ≠ Digital Risk

Every new payment channel (suppliers, ads, logistics) is a fraud vulnerability. One chargeback can shatter an SME’s trust in digital payments.

Banks hesitate: “Will SME cards increase our fraud exposure?”

The answer? Not if you layer the right defenses:

✔ AI-powered, real-time fraud monitoring

✔ Dynamic spend controls (merchant-specific limits, velocity rules)

✔ Virtual cards + tokenization to minimize exposure

The goal? Enterprise-grade security for businesses of all sizes.

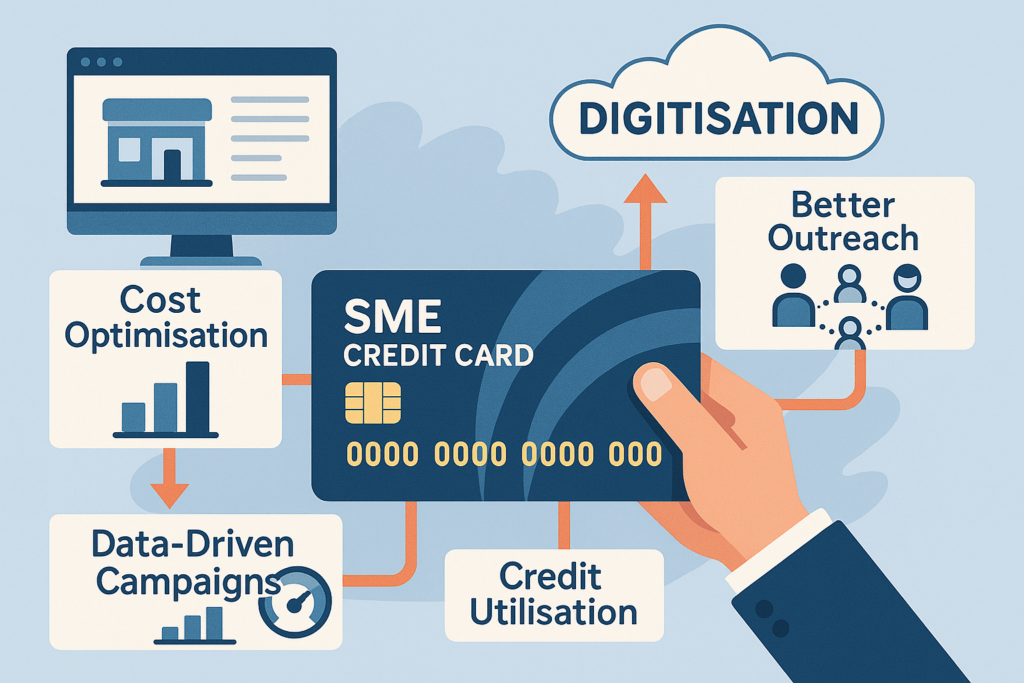

🚀 Stop Selling Cards. Start Solving Problems.

The best SME programs don’t lead with “here’s a shiny new product.” They embed payments where they matter most:

→ Supplier payments (no more manual reconciliation)

→ Marketing & ads (controlled budgets, instant approvals)

→ Employee expenses (automated tracking, no more spreadsheets)

Winning formula? Fewer vanity features, more frictionless flows.

🤝 Why Banks Can Move Faster Than Ever

Mastercard, Visa, and fintechs have already built the rails:

🔹 Mastercard Biz360 – Digital tools for SME efficiency + security

🔹 Visa Commercial Pay – Virtual cards + spend controls for B2B

🔹 Fintech partnerships – Faster onboarding, alternative underwriting

The pitch to banks shouldn’t be: “Let’s launch a card.”

It should be: “Let’s solve working capital, fraud, and cash flow headaches—with zero added risk.”

💡 The Bigger Vision

This isn’t just about payments. It’s about:

✔ Driving financial inclusion for SMEs

✔ Growing commercial spend volumes safely

✔ Becoming a long-term partner—not just a lender

The tools are ready. The demand is there. The question is: Which banks will lead the shift?

Thoughts? How else can banks build SME programs that actually move the needle? Let’s discuss.