A2A Payments Meet AI: How Real-Time Transfers + Instant Credit Could Revolutionise SME Finance in Southeast Asia

From Instant Payment to Instant Credit – In One Tap

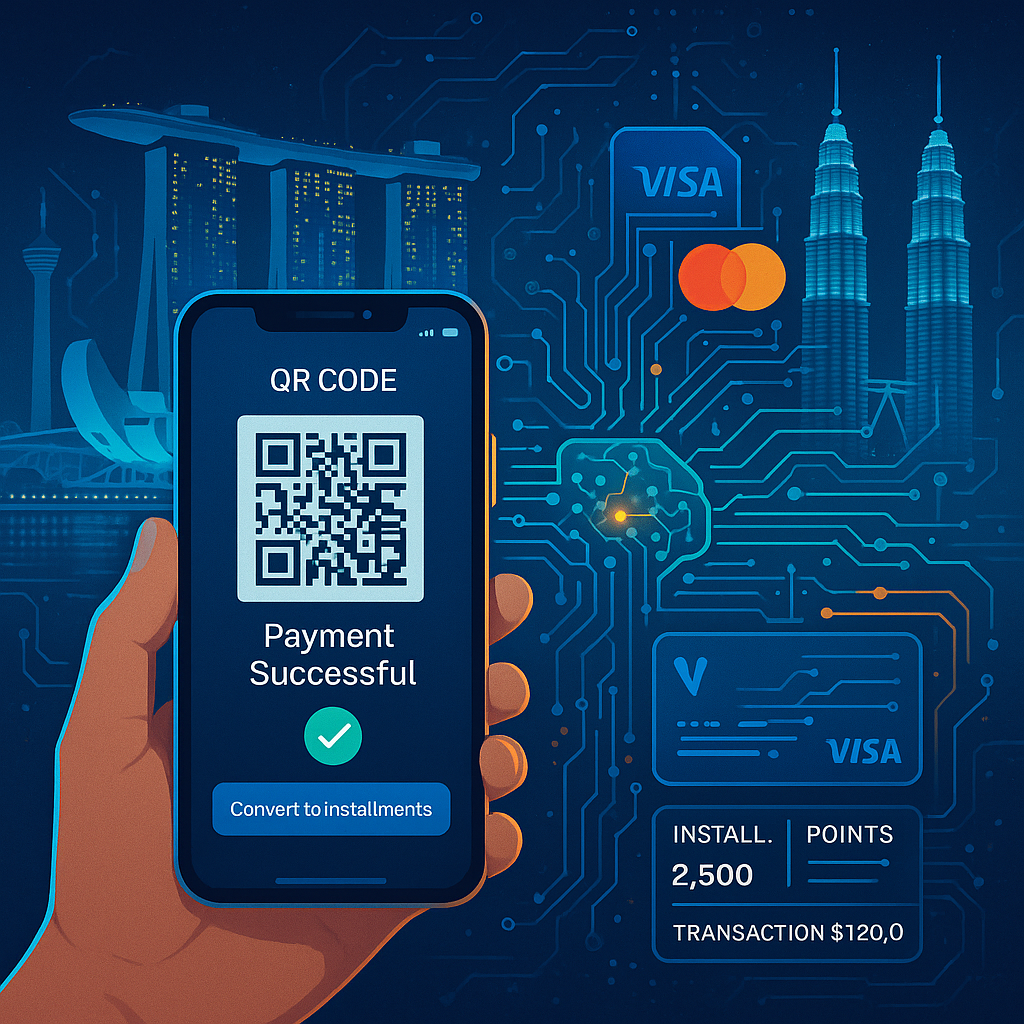

Imagine you’re shopping at a local SME in Jakarta. You scan a QR code to pay directly from your bank account—instant and seamless. But what if, moments later, your phone offers you the option to convert that payment into a card-based installment plan, complete with reward points?

This isn’t a futuristic dream. With the integration of generative AI, real-time payment systems, and advanced card scheme APIs, this scenario is becoming a reality. This fusion has the potential to transform the financial landscape for consumers and small businesses across Southeast Asia.

Southeast Asia’s Real-Time Payment Boom

The region has witnessed a surge in account-to-account (A2A) payment systems:

- PayNow (Singapore): Enables real-time fund transfers using mobile numbers or NRIC/FIN numbers .

- PromptPay (Thailand): A rapid-growing instant payment service developed by Thai banks and Vocalink, a Mastercard company .

- DuitNow (Malaysia): Allows instant fund transfers using identifiers like mobile numbers or NRIC numbers .

- QR Ph (Philippines): A QR code standard facilitating quick and secure payments .

These systems are cost-effective, fast, and ideal for SMEs. However, they currently lack integrated credit options.

The Big Idea

- Payment Initiation: Buyer pays via A2A or QR code.

- Instant Assessment: An AI-driven underwriting engine evaluates the buyer’s creditworthiness in real-time.

- Credit Offer: The buyer is prompted with an option: “Convert to EMI on your credit card & earn points?”

- Transaction Conversion: Upon acceptance, a back-to-back card transaction is initiated.

- Settlement: The buyer repays over time, while the merchant receives immediate payment.

This approach resembles Buy Now, Pay Later (BNPL) for A2A payments—but it’s smarter, safer, and more inclusive.

AI: The Matchmaker in the Middle

Generative AI combined with credit data enhances the process:

- Dynamic Credit Scoring: AI analyzes spending behavior to generate tailored offers in milliseconds.

- Fraud Protection: Integration with Visa & Mastercard’s fraud detection tools allows AI to flag suspicious activities.

- Contextual Offers: Offers are tailored based on time, merchant type, and customer behavior.

- Segmented SME Profiling: AI matches merchant categories with financing trends to create smarter campaigns.

It’s akin to having an AI-powered credit analyst in your pocket—with zero paperwork.

Benefits for SMEs

- Higher Average Basket Sizes: Consumers tend to spend more when credit options are available.

- Instant Settlements: Merchants receive full payment upfront.

- Customer Loyalty: Points, rewards, and status upgrades enhance customer retention.

Advantages for Card Networks

For card schemes like Mastercard and Visa:

- New Volume Flows: Transforming A2A transactions into card-backed spending.

- Enhanced Data & Risk Insights: Better understanding of consumer behavior and risk profiles.

- Increased Loyalty Program Engagement: Driving customer interaction with reward programs.

- Revenue Growth: Monetizing credit offerings without adding friction.

The Global Perspective: Why Southeast Asia is Poised for Transformation

- BNPL Market Growth: Southeast Asia’s BNPL market is projected to exceed $50 billion by 2027, with Indonesia leading at $16.8 billion .

- Real-Time Credit Card APIs: Visa and Mastercard have developed APIs enabling real-time credit card provisioning and transactions .

- Advanced Digital Infrastructure: The region boasts world-class digital wallets and QR payment systems.

- Cross-Border Transactions: Cross-border A2A transactions are on the rise, with initiatives linking systems like Singapore’s PayNow and Malaysia’s DuitNow .

The missing piece? A smart, AI-driven credit layer atop these systems.

Closing Thoughts: A Call to Collaborate

There’s no need to replace existing A2A or card systems. Instead, we should integrate them. By leveraging real-time data, predictive AI, and established card infrastructures, we can unlock a new paradigm in purchase financing—one that’s frictionless and low-risk.

If you’re involved in payments, lending, or fintech strategy in Southeast Asia, this could be your next significant opportunity.

Let’s connect and explore the possibilities.