Let’s be honest — launching a new SME credit card program often feels like assembling IKEA furniture without the manual. You know it’s going to be great when done, but there are screws missing, people arguing, and someone’s yelling, “Just use UPI!”

As someone who’s spent the better part of my career in the trenches of card issuance, merchant acquiring, loyalty, and alternative payments across APAC, I’ve seen banks and fintechs alike dance around SME card programs. But the truth is — when done right — they can be absolute game-changers for banks. Not just from a “look-we-launched-a-product” perspective, but in terms of revenue, stickiness, and ecosystem play.

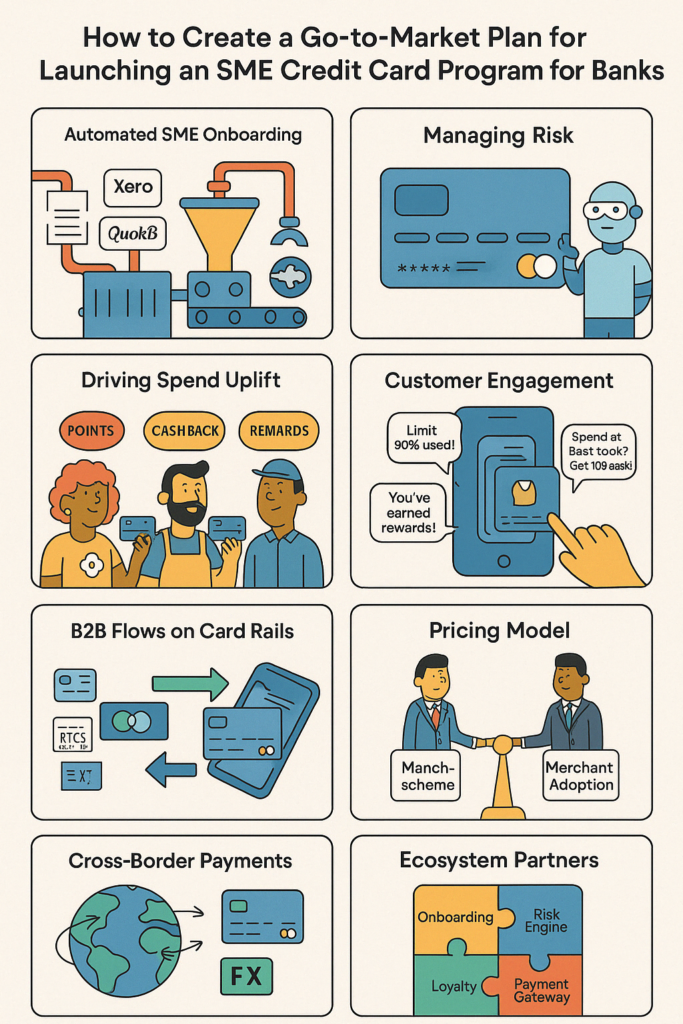

So how do you create a go-to-market (GTM) plan for an SME credit card that doesn’t just exist, but actually thrives?

Step 1: Fix Onboarding — Because SMEs Don’t Have Time for Your 7-Page Form

SMEs today are digital-first. They don’t want to stand in line, submit 45 documents, or wait 3 weeks for a credit decision.

Automated onboarding through API integrations (think: KYC, KYB, GST data scraping, digital credit scoring) is no longer a luxury — it’s hygiene.

Bonus points if your system integrates directly with cloud accounting tools (Xero, QuickBooks) for dynamic credit line decisions.

Step 2: Manage Risk — But Don’t Kill the Excitement

Yes, SMEs come with higher risk. But guess what? So did every startup before they became unicorns.

Smart use of:

- Virtual credit limits linked to transaction categories

- Real-time spend controls

- Supplier categorization

- Embedded insurance

…can help you build a risk-aware, not risk-averse product.

Step 3: Make It Swipe-Worthy — Spend Uplift Starts with the Right UX

An SME card should not be a “me-too” product. It should:

- Allow physical + virtual issuance (imagine a fleet manager getting virtual fuel cards in seconds)

- Enable instalments for B2B purchases

- Offer rewards that actually matter (skip the spa voucher, give cashback on logistics and SaaS tools)

Create segment-based campaign templates to target micro, small, and medium businesses differently. Your florist and your freight company have very different needs!

Step 4: Build a Real Engagement Plan (Emails ≠ Engagement)

Want to keep your SME customers engaged? Think like a loyalty marketer.

- Integrate your card into a closed loop rewards ecosystem for everyday business spend

- Offer points-for-payments, access to business tools, and early pay discounts

- Use WhatsApp, not email, for proactive nudges (“Hey, your spend is 90% of your limit. Want a top-up?”)

And yes, webinars for SMEs are still a thing — if they come with coffee and real value.

Step 5: Drive B2B Flows On Card Rails — It’s Time to Move Away from RTGS and Cheques

Here’s where virtual cards shine. Instead of traditional banking instruments:

- Use single-use virtual cards for vendor payments

- Enable reconciliation using enriched data

- Create buyer-seller platforms where card payment is a default

You’ll shift large B2B volumes on card rails, bringing in interchange, MDR, and precious data.

Step 6: Tackle Pricing — Dear Schemes, We Need a Heart-to-Heart

Standard SME pricing models often don’t cut it. High interchange fees can kill the use case.

Schemes need to:

- Create custom SME interchange programs

- Offer volume-based rebates to banks and issuers

- Support cross-border programs with competitive FX spreads

Let’s be real — the competition here is not another card. It’s SWIFT, and nobody’s sending a happy emoji after using SWIFT for a payment.

Step 7: Cross-Border — Hello, Global SME!

SMEs are going global. Why shouldn’t their cards?

A virtual card program with multi-currency wallets or optimized FX routing helps:

- Reduce payment costs

- Increase visibility and control

- Allow real-time reconciliations

Banks should integrate with platforms like Wise, Airwallex, or Nium — not to compete, but to collaborate. These players help banks deliver global payment capabilities without rebuilding the wheel.

Step 8: Build Your Ecosystem — You Don’t Need to Go Solo

Let’s ditch the “build everything in-house” mindset. The best GTM plans involve:

- Fintech enablers (for onboarding, risk scoring, loyalty, APIs)

- Payment processors with SME-first capabilities

- Marketing partners who understand SME lifecycle

They’re not competition. They’re your shortcut to speed and agility.

Finally:

Banks that truly get SME cards right won’t just issue plastic. They’ll unlock new revenue lines, increase SME stickiness, and build ecosystems where SMEs thrive — with cards at the core.

It’s not just about the card. It’s about becoming the financial OS for SMEs — and if that’s not exciting, I don’t know what is.

So here’s a question for all the schemes, banks, fintechs and enablers out there:

What’s the one thing holding you back from launching your SME card program today?